| Take | 您所在的位置:网站首页 › virtual shopfront › Take |

Take

|

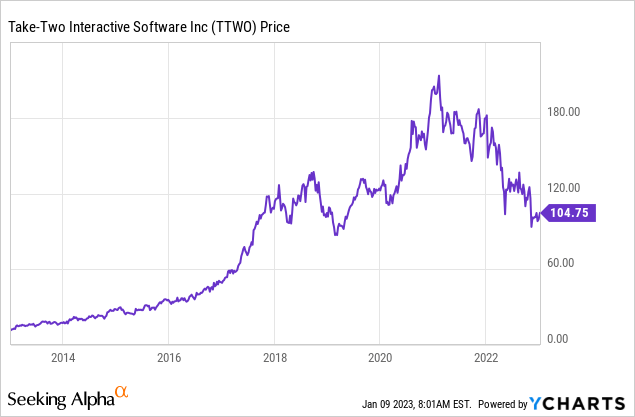

Marko Geber Company description:Take-Two Interactive Software, Inc. (NASDAQ:TTWO) develops, publishes, and markets interactive entertainment for the masses. The company operates under several different operating brands, including Rockstar Games, 2K, Private Division, and T2 Mobile Games names. The most famous games within these brands are Grand Theft Auto, NBA2K, and Red Dead Redemption. The company has done incredibly well to differentiate its offering, covering games across all genres and consoles. We have covered other gaming / entertainment stocks, including Embracer (OTC:THQQF) (linked) and Corsair (CRSR) (linked). Take-Two made the news in 2022 when it acquired Zynga in an all-share $12.7BN deal, which was at a 64% premium. Zynga specialized in social games, aimed at the casual user. Their pricing model is predominantly free-to-play, with in-game purchases positioned to attract regular transactions. For reasons we will explain later, we are very bullish on this purchase, and believe it puts TTWO at the forefront of a key growth area in gaming. TTWO's share price has returned fantastic gains over the last two decades, with much of the growth coming post-2014. This was driven by the incredibly successful release of GTA V, which is still highly monetized to this day. We do observe a sharp decline of c.50% from its ATH in 2021, with demand slowing and outlook weakening.

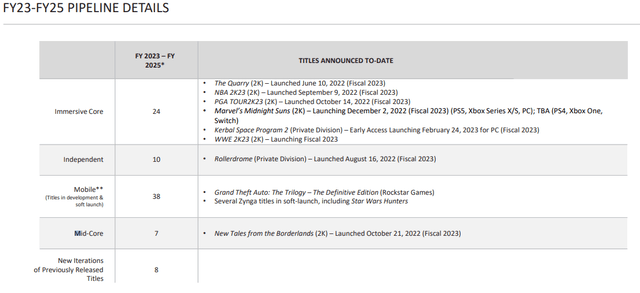

TTWO has an undeniable attractiveness. With great growth, a fantastic catalogue and historic share appreciation. With a pullback to 2019 levels, now is a good time to take an objective view of the business. Much of our analysis will focus on the gaming industry, with an eye for how growth will shake out. With a large purchase under their belt, TTWO's focus will be on justifying the purchase. We will also consider how macro-conditions will impact the near-term performance and what the financial profile of the business looks like. With many competitors, we will finish with a relative comparison, to see if investors are getting a good deal today. Gaming industry:The gaming industry has been an incredible success story in the last few decades. Innovation has remained high, and the number of users has continued to grow. There are very few people on earth with access to a mobile phone who have not gamed at one point or another. Morgan Stanley (MS) believes video games will be in for a strong 2023. This is so long as they can release AAA titles. Looking at TTWO's pipeline, it looks strong even before considering the long anticipated GTA VI.

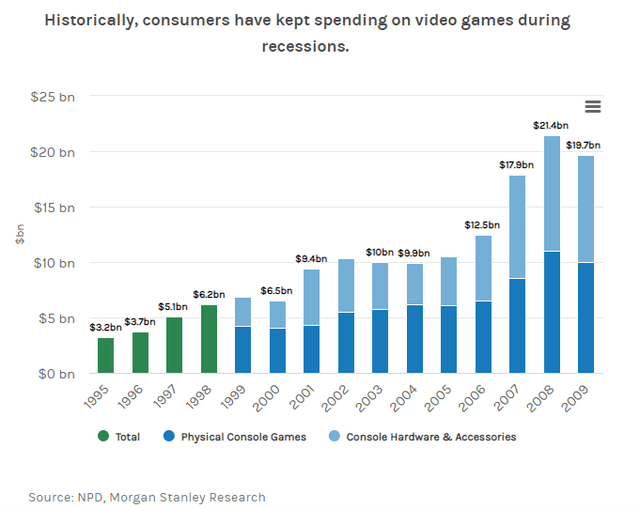

Pipeline (Q2 investor pack) Further, MS believe greater ownership of next-generation consoles will further propel demand. This is interesting, as PlayStation only recently announced their PS5 shortage is finally over, perfectly timed for a full year of sales. Finally, MS believe a recession is not to be feared. The reason can be summarized in one succinct sentence: "Staying at home fighting zombies is generally cheaper than a night out with friends, even with the initial investment in games and consoles."

Consumer spending on gaming (MS / NPD) PricesOne concerning theme in the gaming industry is the developments in pricing. New AAA titles historically were priced at £40-60 and that was it. Now AAA games are £80+, with most games having convoluted pricing models, which mean the consumer does not pay just the box price. As an example, EA made over $1.6BN from FIFA ultimate team in 2021, which is in-game purchases after the game itself has already been bought. Most in-app purchases are layered into the development of the game, requiring little in the way of additional work. Thus, the accretive gains from in-game purchases are massive. Consumers are not happy with this however, with many complaining and a general sense of decline in the quality of games. As an example, EA received the most downvoted comment in reddit history, as it tried to explain why consumers actually liked in-game purchases. For this reason, it feels like there is a "peak monetization" level, which we are approaching. This will impact how much further margins can improve going forward. Mobile gaming

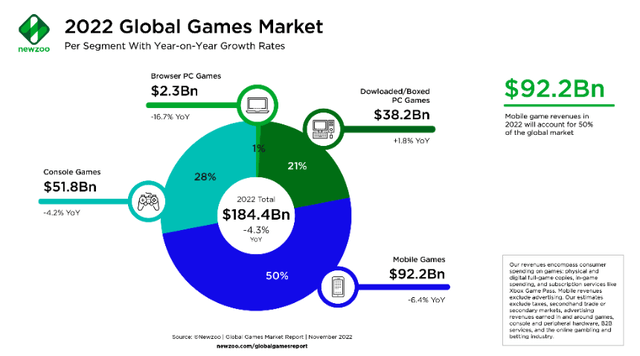

Market segment (NewZoo) NewZoo estimate that the mobile gaming segment is now 50% of the global market. This development has been spearheaded by consistent innovation by the Apple (AAPL) and Android (GOOGL) app stores, game developers and mobile phone producers. With more choice than ever and the computing power of mobiles at its highest level, consumers are choosing the convenience of mobile gaming. Importantly, this is bringing in the segment of people who do not consider themselves gamers but need some form of flexible entertainment. The segment had a rocky 2022, declining by 6%. The driving factor of this is 3 things. Firstly, Apple changed their privacy settings on IOS, reducing the amount of user data companies can take. This means companies are less able to target customers and could mean a strategy shift is required going forward. Secondly, with lockdowns ended, consumers are returning to their daily lives and less interested in actively gaming. Although both points suggest a fundamental issue in the segment, we believe these will not be an issue in the medium term. User data is most valuable for marketing purposes but mobile games financial success stems from their ability to layer in monetization. As for lower gaming post-COVID, this brought many people in the market who otherwise would not have. These people may be gaming less, but they are unlikely to stop and if anything, may move towards more casual games. The 3rd point however, is concerning. Morgan Stanley believes the market is reaching saturation, and so quality content will be king in-order to increase their slice of the pie. Metaverse, Cloud gaming, Crypto gaming and VRWhat do these 4 small segments have in common? Nothing really. We highlight them because they are still relatively small segments which have the opportunity to grow to the forefront of gaming. VR is the most developed, but equally is the most difficult to sell to the masses. Importantly, these all give consumers more ways to play and enjoy games, which can only increase the total addressable market. Of these four, we are most bullish on Cloud gaming, followed by VR. Cloud gaming allows for games to be streamed online rather than owned, meaning greater convenience and more games that can be played. What is attractive for TTWO is that it needs to do very little to benefit from cloud gaming, as it is just a virtual shopfront. Financials:

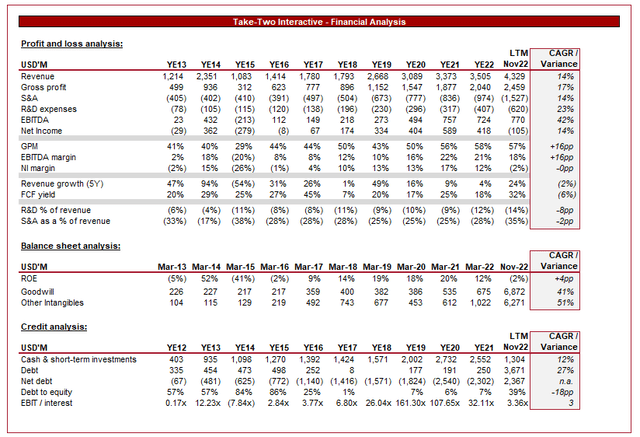

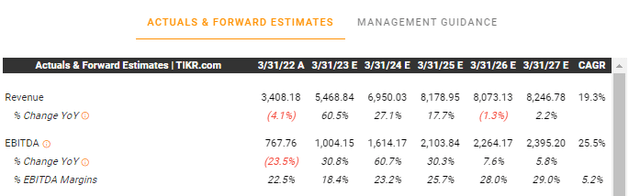

TTWO - Financials (Tikr Terminal) TTWO has shown impressive results over 10-years, improving in almost all metrics. Revenue has grown at a CAGR of 14%, driven by the highly successful release of GTA V. Alongside this, TTWO have developed countless other AAA titles, which release periodically to much acclaim. Similar to the largest two publishers, Electronic Arts (EA) and Activision (ATVI), TTWO has several annual releases (NBA, PGA Tour, and WWE). The benefit of these is that incrementally improved AAA titles can be released to a large number of sales (Independent AAA titles are expensive and time-consuming to create, meaning great risk). S&A expenses have increased noticeably in the LTM period due to the addition of Zynga, who incur higher marketing spend and personnel costs, relative to TTWO. R&D spending growth has outstripped revenue but reflects the ever-changing nature of the gaming industry, where innovation and greater spending is required in order to produce the most complex games possible. Further, TTWO are trying to increase their footprint, which means more content relative to their size. Over the historical period, margins have improved aggressively as TTWO have found ways to monetize its current IP strategically. As an example, they have continually released updated to GTA V's online content. Margins should remain at this improved level with the inclusion of greater mobile gaming coming from Zynga, who had a GPM of 64% and an EBITDA margin of 17.9%. This has contributed to an incredible free cash flow ("FCF") yield of 32%, although realistically it is unlikely to stay this high. Normalizing in the high 20s would be fantastic regardless. In order to incorporate Zynga, the businesses financial position has changed. The business has taken on a large amount of debt and spent much cash. The business remains conservatively leveraged however, and we consider there to be no credit risk. OutlookAnalyst are forecasting tremendous growth for TTWO in the coming years, with the release of GTA VI seemingly forecast for 2023/2024. We think this is unlikely, and far more realistic in late 2024 or early 2025. Regardless, the demand will be there when it comes out, and so if investors look to benefit from this growth, they must hold for the release.

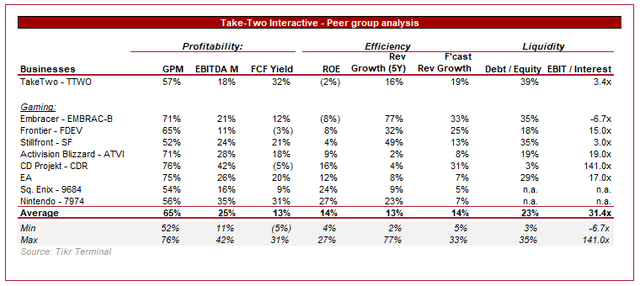

Analyst forecast (Tikr Terminal) Overall, the Take-Two Interactive Software, Inc. business is incredibly attractive. Investors are looking at high margins and high growth, not much more you can ask for if fairly priced. Peer comparison and valuation Relative performanceThe gaming industry is incredibly attractive. Businesses are growing quickly and are highly profitable. Take-Two Interactive Software, Inc.'s relative performance is slightly above average in the market, as their far superior FCF yield trumps a slight weakness in margins. Further, TTWO is aggressively investing in marketing, something EA, Sq Enix and Nintendo are not doing. When comparing revenue growth, we have excluded Embracer and Stillfront, which are both growing aggressively through acquisitions. When excluded, we observe further outperformance in both historic and forecast growth. The key going forward is TTWO's pipeline, GTA VI is a guaranteed record-breaking game.

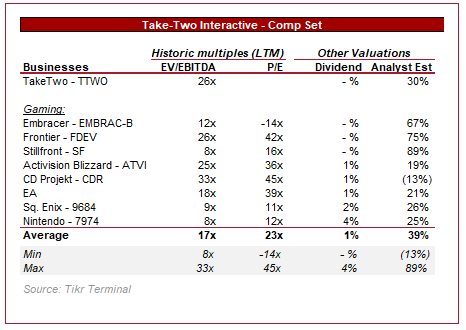

Peer group comparison (Tikr Terminal) Overall, we believe TTWO is a market-leading business in the gaming sector. Their main competition is Activision Blizzard and CD Projekt, who both have several high-quality titles and elite financials. ValuationTTWO is currently trading at 26x EBITDA and NTM P/E ratio of 23x (LTM P/E ratio is materially impacted by non-trading items). At this valuation, TTWO is trading at a premium to its peers, with analysts expecting 30% upside from here. Looking further into the numbers, the ATVI / CDR average is 29x / 40x, which puts TTWO in undervalued territory. It is difficult to attribute a fair value due to the uncertainly around quantifying growth for games not yet close to release. Further, it is too early to suggest mobile gaming has peaked, it could just be a correction. Given the quality of growth, profitability profile and pipeline, an EBITDA around 30x is the top-end of appropriately valued. The average multiple between 2016-2022 was 35x, which includes the value of a successful GTA release. At sub-30x, you get Zynga but bear the risk of GTA being delayed or being underwhelming. Peer group valuation (Tikr Terminal) Investment risks Macroeconomic conditionsWe begin with a look at current economic conditions, as it provides a backdrop for where things will go in the near term and to help investors decide about whether to invest now. Equity markets began an almost yearlong fall in 2022, as a result of a change in economic outlook. Inflation began to increase, and increase quickly, causing the realization that it is unlikely to be transitory. Compounding this was the Russian invasion of Ukraine, causing energy prices to spike. Interest rates have been increasing in response to this in order to cool demand. This has led to a cost-of-living crisis for many low to medium income households, and with equity markets falling, the rich have been negatively impacted also. Looking ahead, our belief is that things will continue to worsen. Inflation remains above 5% in most of the West, with futures markets pricing in further rate hikes. Based on this, interest rates will only begin to fall in late 2023, early 2024. Gaming is a discretionary industry and so likely to be negatively impacted by this. With a squeeze on incomes, we could see expenditure on games reduced, and console purchases deferred. If we use 2008 as a comparison, the result may be surprising. Console sales were indeed down high single digits, but the sale of games was at record levels. The reason for this is the relative elasticity. With games costing a small amount of monthly income and having the potential to entertain for a long period of time, consumers are more willing to incur the cost regardless of a downturn. This does require the quality of games to be attractive enough, as 2008 had GTA IV. 2022 has not shown such attractiveness, with sales down. Zynga peakingAs we have mentioned previously, there is a real risk that mobile gaming may have peaked. Should this be the case, there is great pressure on Zynga to maintain growth and margins, neither of which is a certainty. The opposite could occur, with the mobile business bringing down the profitability of the Group. With TTWO paying a 20x+ multiple of EBITDA, growth is required to earn a sufficient return. GTA VIGTA VI will almost certainly be a success, whether it is a good game or not. Some brands / titles are irresistible to the public, and it is one of them. The beauty of GTA V from a business perspective was that it was monetizable long-term, which comes from a love of the base game. It's a lot easier to upsell people once you have their admiration and interest. Should the game not live up to the hype, or an aggressive pricing model put consumers off, there is a risk that this alienation leads to people playing the game's campaign mode for the experience and never return. Thus true success of GTA VI will be seen in years 2-3, rather than based on year one sales. ConclusionTake-Two Interactive Software, Inc. is an incredibly successful gaming business. Smart monetization of GTA V has allowed the game to propel the business to the forefront of gaming, allowing for further investment into diversifying their offering. The business now has its hands in many pies, all of which we believe will grow well going forward. Morgan Stanley believes the macro conditions will not materially impact games but rather consoles, which is great for TTWO. The company is certainly not cheap, and investors could face sideways trading, but we believe the medium term is a homerun with GTA VI on the way. We rate Take-Two Interactive Software, Inc. a soft buy. Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. |

【本文地址】

Data by YCharts

Data by YCharts